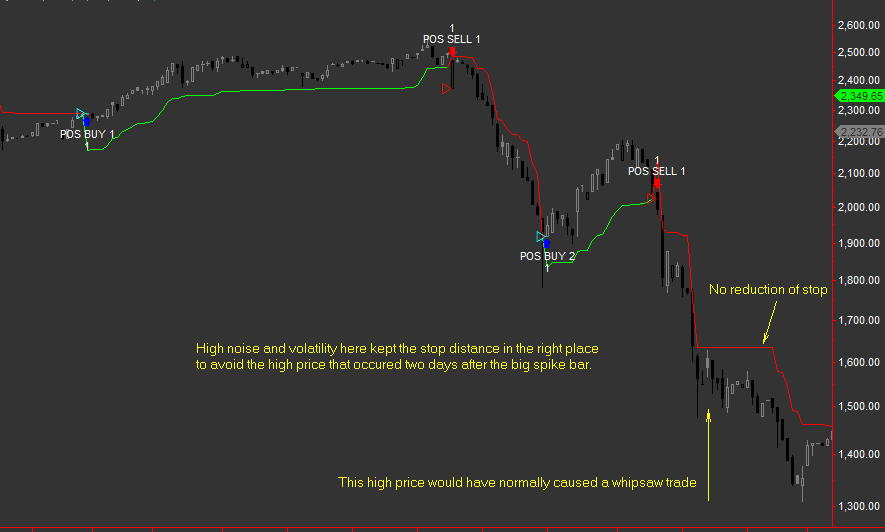

Precision Stop below on E-mini SP500 futures on a 10 minute chart shown with Multiple setting of 0.2

Please visit the product guide above if you require this

for a different platform.

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles -

less

than 10 emails a year and ZERO spam and ZERO hard selling Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation. MultiCharts, TradingView,

MetaTrader 4 and MT5

-

Admin notes

Page Created June 15th 2023 - New responsive page GA4 added canonical this. 5/5 html baloon

Cookie notice added

Precision Stop uses a complex volatility algorithm to automatically compute its distance from the price action helping you follow the trend

This indicator for NinjaTrader 8 is a robust and extensively tested trading system that helps you cut losses and ride winners in a pure trend following style

Indroduction and concepts of the Precision Stop strategy and indicator for NinjaTrader 8

This product uses similar

operational logic to Welles Wilder junior's creation Parabolic SAR (

Stop And Reverse )

The main difference is the intelligent

multiple look back volatility measurement that is built in to the

Precision Stop algorithm and not in Parabolic SAR, which enables a

more accurate and "appropriate" stop distance to be calculated.

Parabolic SAR is computed with an accelaration factor which

makes it grow ever tighter, while the Precision Stop GOLD sets the

exit distance based on the true volatility of the historical AND

local volatility or the market data.

I have the utmost

respect for Mr Wilder's superb creation but I am sure he would admit

this method of setting stop distance is a more logical and accurate

definition of setting the initial stop distance and the final

distance as the trend develops. The tool is designed for the

dedicated trend following trader.

Below you can see the

new feature added to this NinjaTrader 8 version which allows

different contract sizes for long or short

For example, if

you believe the bull market is strong you can set long contacts to

10 and short contracts to 1 as show in the image below rather than

have a fixed size in both directions

Special features of the Precision-Stop indicator for NinjaTrader

8

A new feature is added the

this NinjaTrader 8 version which allows different contract sizes for

long or short

For example, if you believe the bull market is

strong you can set long contacts to 8 and short contracts to 1

rather than have a fixed size in both directions.

There are

two versions: GOLD for experts, SILVER for intermediates ( Indicator

only )

The indicator ( all versions) are enabled to work on

FOREX

The Precision Stop Strategy does NOT function when

applied to FOREX, This is due to the two data streams which

NinjaTrader 8 produces in FOREX charts.

System introduction

Precision Stop has been tested extensively and is ultra robust

and reliable ( The video lower down this page shows these tests )

Precision Stop follows the tried and tested rules of trend

following with the correct logic applied automatically.

Precision Stop has high risk to reward ratios and moderately low

draw downs in comparison to other high performance trend following

models.

Precision Stop has been tested and has been approved

by NinjaTrader technicians

Advanced features

Precision Stop Strategy has latency protection included in the

GOLD and SILVER versions. ( See explanation lower down page)

Precision Stop has advanced volatility detection with three

different types of "memory look back" to take the guess work out of

placing stops .

Precision Stop contains a complex volatility

formula which is unique and was specifically designed solely for the

algorithm of this model.

Precision Stop has a huge range of

multiple settings for microscopic adjustment to fit any data

behaviour.

Precision Stop has a minimum percentage setting to

allow extra flexibility for user settings

Precision Stop has

a maximum percentage setting to restrict maximum stop distances if

users require them.

Precision Stop can be used as a fixed

percentage model if required. ( Setting maximum percent and Minimum

percent to the same value )

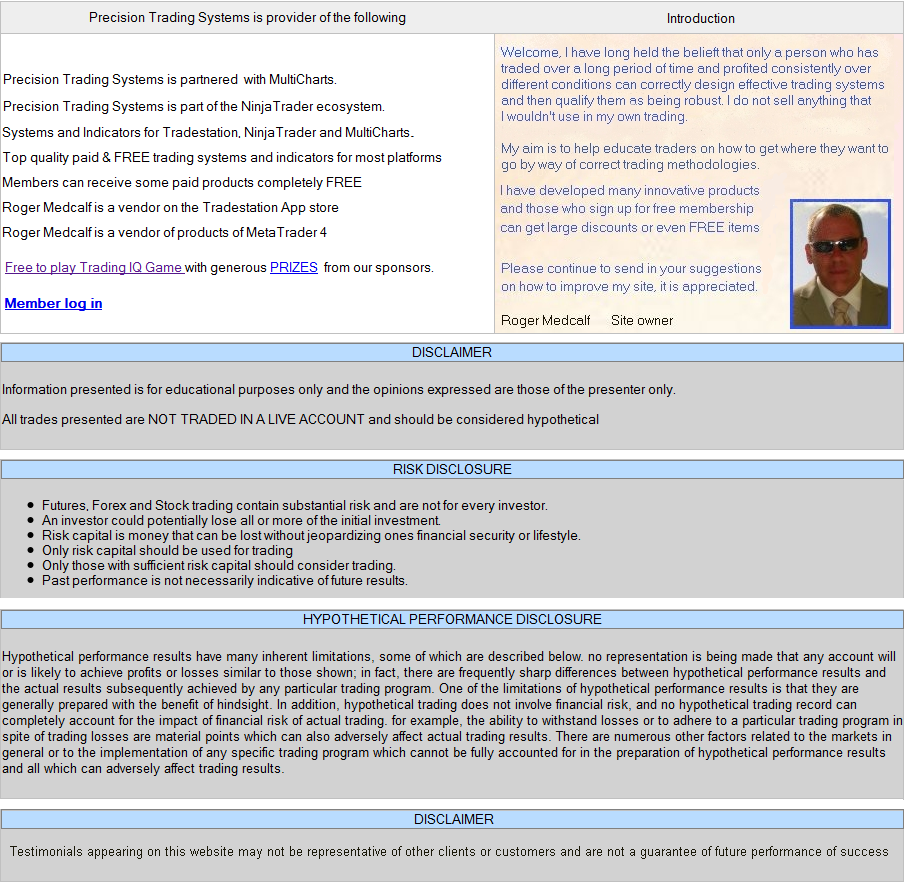

With the shot below you can see

the stop tightened before going long, then widens as the uptrend

continued.

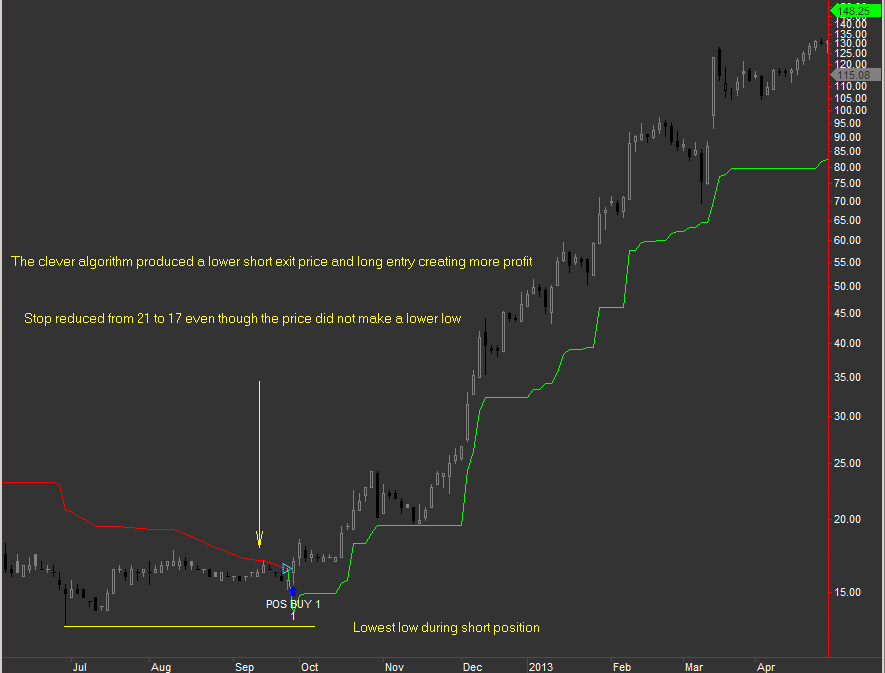

Protection from latency

Precision stop PROTECTS YOU from latency in a fast moving

market.

Latency, or the delay in the transmission of data,

can have significant implications when trading futures. One example

of latency in futures trading is network latency, which refers to

the time it takes for data to travel between a trader's computer and

the exchange's servers. This delay can occur due to factors such as

distance, internet connection speed, and network congestion.

Causes of latency in trading

systems are due to the actual market data flow being so fast that

combined processing time of the internet connection and the speed of

the users pc cannot process fast enough to keep up with changes in

trend detected by strategies.

EG When a trading system switches from long to short it

has a few things to do. First it must exit the long trade, then it

would enter a short trade and place a stop loss for that new short.

Such a scenario would only be experienced using very tight stops

on very fast markets and if Precision Stop ever encounters such

conditions it will close out any open trades and go flat for 30

seconds. After this period is over the system will resume again.

This feature is put in place to protect you from losses which might

occur if your pc is slower than those used by professional

institutions who are engaged in high frequency trading activity.

You can relax because The Precision Stop strategies have

automatic protection from latency. Shuts down for 30 seconds then

resumes.

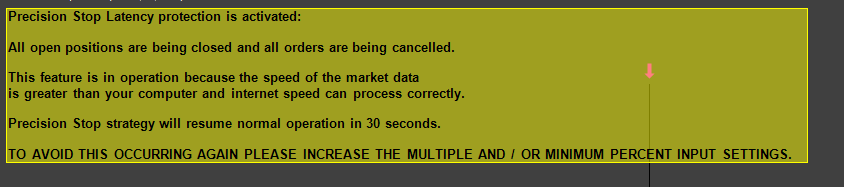

The shot below shows the Precision Stop does not reduce its

distance unless it is appropriate to do so.

Standard

features of Precision Stop

Precision Stop Indicator has an accurate colour changing

plot that provides at a glance position / trend detection depending

on colour

Precision Stop default use is as a stop and reverse

model ( Operating behaviour is similar to Parabolic SAR created by J

Welles Wilder, jr )

Precision Stop strategy is fully

optimizable so you can rigorously test all the settings for best

performance.

Precision Stop works on bar, candle and line

charts in the NinjaTrader 8 platform. ( See user guide for more

information )

Precision Stop can be executed directly from

NinjaTrader control centre ( without having a chart open )

Technological advancements

Precision Stop has been completely re-programmed in fast

efficient C# code to handle all the different scenarios it may

encounter in markets.

Precision Stop was converted to VB.Net

for the purpose of creating an independent simulation unit for

testing which is shown in the video lower down this page.

The chart below shows the differences between the GOLD

and SILVER versions of Precision Stop

Check out license prices for Precision Stop Indicator and

strategy for NinjaTrader 8

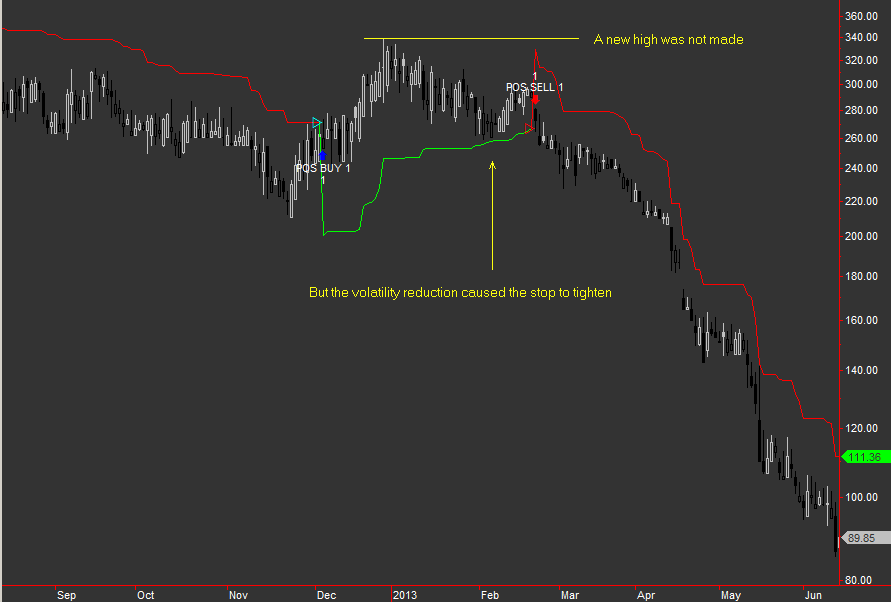

You can observe the high price at 330 produced an initial stop level

at 240, however even though no new high was made during the long

trade the complex algorithm detected a decrease in volatility and

tightened up to 260 resulting in a long exit and short entry 18

points lower is clearly better.

View license prices for Precision

Stop Indicator and Strategy for NinjaTrader 8

User guidelines

After importing

it the Precision stop Indicator will appear in the Indicator list

and the strategy ( if you purchase gold or silver version ) will

appear in the strategy list.

Setting up the indicator on a

chart.

When starting for the first time it is best to attach

the indicator first to obtain a visual examination of the

approximate settings you want.

IMPORTANT

Precision

Stop ( GOLD and SILVER versions ) are ONLY designed to be

used on the following chart types in the NinjaTrader 8 platform.

Candlesticks or OHLC Bars in the format of Volume, Tick, Minute,

Days, Months Weeks, Volume, Range

Renko, Kagi, Point and

figure or Line Break charts cannot be used due to the nature of

their "in hindsight" processing of real-time information or

inability to plot high and low prices accurately on each bar.

In strategy back testing of these chart types ( mentioned above

in RED font ) can lead to misleading performance results for this

product.

Default settings for the indicator.

Calculate on bar close = false.

This setting is important to

leave as false because precision stop detects changes "intra bar" .

If a bar opens at 100 and makes a massive move up to 190 in the same

bar then retraces back to 185 the precision stop would be able to

exit with a great profit. However if the calculate on bar close is

set to true, it would not monitor the price action until the bar is

closed which could mean that the unrealised profit is never

realised.

The default setting for Precision stop Multiple is

0.65. Please note this is a general approximation of an effective

setting when applied to daily charts and users are encouraged to

extensively test many settings before engaging the strategy.

The multiple setting is simply a multiplication factor of the

distance computed by the Precision stop algorithms. EG If you set

this to a large number of 2 or 3 or more it will fit uses on long

term daily or weekly charts and if you set it to values smaller than

0.5 it would be more suited to intra-day charts. Each version of

Precision Stop GOLD, SILVER versions have minimum and

maximum settings for the multiple which you can see on this table

below.

EG. If plotting a 1 minute chart the PS will get to

work and detect the data volatility and produce a value which

represents an accurate reflection of market conditions. If the same

symbol was then analysed on an hourly chart the outputted value

would be much larger. This is because it can view a larger time

period of market action the more long term the chart is.

You

will see that if you use a constant multiple setting on different

chart timeframes the distances it creates will be different. This is

because if you choose a 10 minute chart the data volatility will be

less over the sampling range than it will on a 30 minute chart.

You are encouraged to use NinjaTrader optimizer to optimise the

time period of the chart to see the change in performance.

Multiple settings approximate guidelines for different chart periods

User guide continued.

Please note that using this product on very tight settings is

likely to use up a lot of commission costs and is not generally

recommended unless market conditions are extraordinary.

The

default setting for Precision stop GOLD Minimum percent is 0.5. This

value is used to force Precision stop to be wider that it would

perhaps be if a small multiple setting is used. You are encouraged

to experiment with many different time frames of chart and different

settings to see the power of this product.

The default

setting for Precision stop Maximum percent is 30%. This setting

would mean that if you have very large multiple settings on daily or

weekly charts it would force it to be restricted to a maximum of 30%

away from the price when the signal is given initially. The maximum

allowed setting for max percent is 99.99%. For obvious reasons this

is factored in to prevent a value below 0 being displayed on a long

trade.

Users are advised to thoroughly experiment with these

three settings on the indicator to see how it behaves differently.

Once you familiarise yourself with these concepts you can then

proceed to add the strategy ( for GOLD and SILVER versions ) and try

some strategy optimisations in control centre.

Precision Stop Strategy user guide

After making an initial visual inspection of the indicator on

the chart to find approximate settings you can proceed to do some

optimizations.

It is critically important to remember not to

over optimize and "curve fit" a strategy to a data series as it will

be unlikely to be much use in actual trading.

How to optimize

Precision stop

Users In control panel click on file > new >

strategy analyzer. A box will open with your instrument list.

Click the "O " in between B O W on the top left

Left

click on the instrument you want to optimize and click optimize.

Choose Precision stop from the strategy drop down menu and input

the settings you want to test to and from.

Expand the box by

click on the cross and then type in the min value and max value

followed by the increment

You can choose the period from day

, minute hourly etc and also the date range.

Be sure to add

commissions to get an accurate test

Also you can optimize the

data series which is a very good feature of NinjaTrader. ( This

feature would test it on charts from 1minute to 20 minute for

example and is a very valid procedure to try out )

At the

bottom of the panel is "order handling" please select exit on close

= false otherwise this will force trades to be closed out at the end

of each day and result in over trading and cutting of winners. ( Not

as it is designed to be used )

Press the button "Run

optimization" at the bottom of the screen

On this page (for

advanced users only) is a more in depth method to check a symbol and

instrument and strategy combination for robustness showing

how

to test a trading system

Attaching the Precision Stop Strategy to the chart.

After opening a chart window you can right click the screen >

strategies and choose Precision Stop (VERSION) from the list.

The you can input the settings you observed from the indicator

and make sure they are the same.

Please set Calculate on bar

close to false. Then to enable the strategy click on enabled = true

click apply and ok. The strategy will appear on the chart.

Below is a video simulation showing Precision Stop loaded on 70- UK

stocks over a 10 year period.

The results are visible in the "Closed

Equity" green cell. Watch it grow.

View license prices for Precision

Stop Indicator and Strategy for NinjaTrader 8

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

~About~