HATS 6 - Hyper Adaptive Trade Size

Designed to gradually leg into a position over time as the price moves in the chosen direction: For Futures, Forex, Stocks and Crypto currencies

Tired of those tough decisions to buy or sell? Take some little baby steps to gradually build a position - This product eliminates FOMO so you don't feel it

Day-Trading friendly and also long term investor friendly. This model based on pure logic to remove the fear of opening a big trade by splitting it into small tranches.

HATS 6 is ready for NinjaTrader 8 (up to 6 entry tranches)

HATS Unlimited is ready for MultiCharts and Tradestation (unlimited entry tranches)

The MultiCharts version is DIFFERENT to the NinjaTrader version as it has umlimited tranches, meaning you can buy or sell in any amount of tranches.

A particularly good FAQ about the differences in the versions has been answered in the member forum

| HATS 6 |

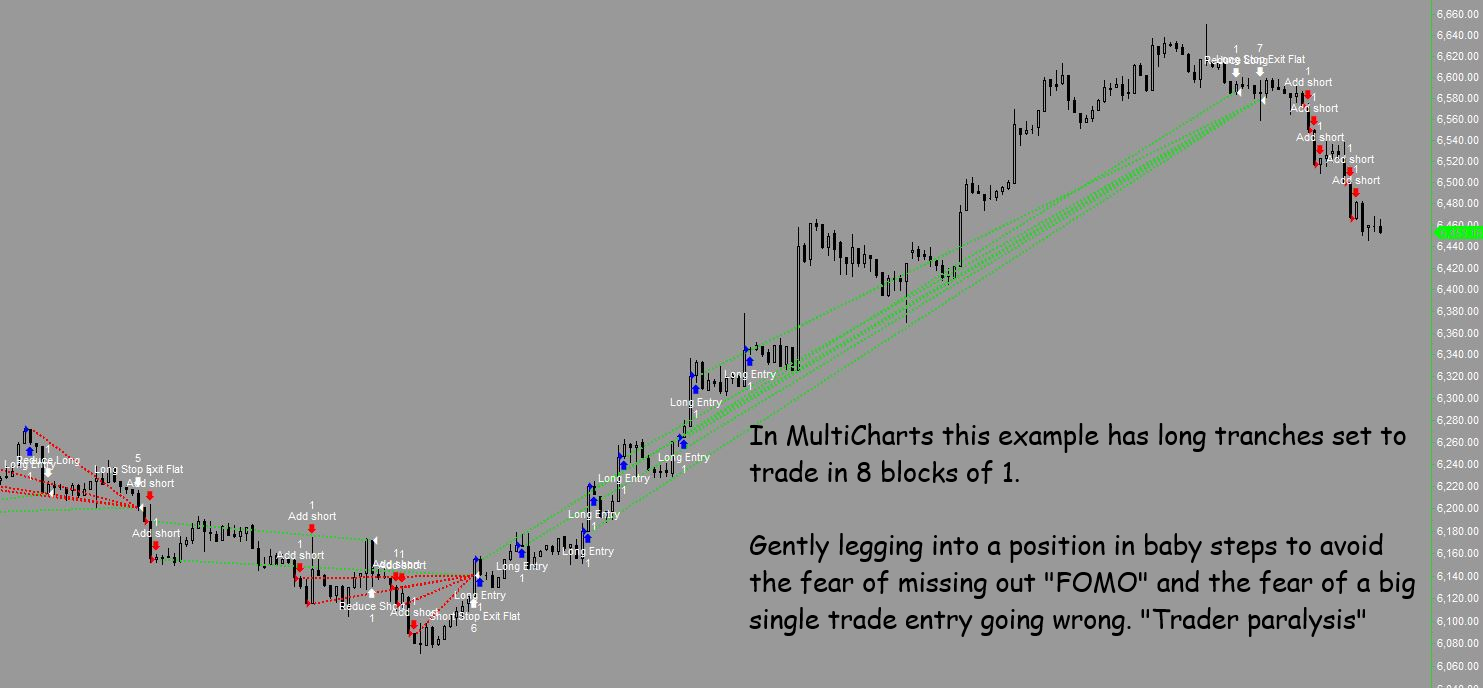

The example below shows 30 minute chart of SP500 Futures ES using the HATS trading strategy with 150 bar low and 150 bar high and Sensitivity set to 50. |

Below Apple stock on 3 minute chart showing the building of a long position of 6 tranches, then legging out in steps and going short. |

| The HATS version for MultiCharts has

UNLIMITED tranches (If you need to know why this is different to

the NinjaTrader version,

read this article) |

|

|

|

|

|

Settings and time frames are important to test as virtually infinite spectrums of results are possible Below is a 120 minute MNQ Micro Nasdaq Futures legging into a six tranch short. Note the blue Buy to cover arrow reduces it by one until it adds another short. On the far right the entire short position is closed when the price hits the HighStop line which triggers a buy at market order which is a short exit. |

|

|

-

In this video clip Long Tranches are set to 0 and Short Tranches are set as 6, catching a big move down on GBPJPYObserve the gradual legging in from 0 to 6 tranches of short trades. |

-

| HATS 6 The features and what they do. |

Adjustable parameters include. 1. Sensitivity which adjusts the width of the entry lines. Minimum value is 30 and Maximum is infintite. Accepts decimal place for fine adjustment. 2. Low Stop Bars this sets the 80 bar lowest close and triggers the entire long position exit. (Sell at market orders - adjustable from 8 to infinity) 3. High Stop Bars this sets the 30 bar highest close and triggers the entire short position exit. (Buy at market orders - adjustable from 8 to infinty ) 4. Show Plots The strategy has an indicator plot built into it and if the box is ticked the four lines will be displayed 5. Long Tranches The number of tranches or blocks of long trades that you want to use ( Set from 0 to 6) The MultiCharts version is unlimited 6. Long Size The size of each block of contracts or shares you want to buy ( Set from 0 to 100,000) 7. Short Tranches The number of tranches or blocks of short trades that you want to use ( Set from 0 to 6) The MultiCharts version is unlimited 8. Short Size The size of each block of contracts or share you want to sell short ( Set from 0 to 100,000 ) |

HATS 6 for NinjaTrader 8 licenses HATS Unlimted for MultiCharts licenses HATS Unlimted for Tradestation licenses (ready now) 2 month trial $69 1 year license $135 5 year license $285 10 year license $385 To get a 5% Discount you can pay in CHF or if you want a 10% discount you can pay in BTC |

| HATS are useful to remember Hyper Adaptive Trade Sizing | Kristen order the HATS 6 trading system before Barnes gets it |

|

|

|

-

HATS 6 The general concepts. |

A very well know businessman publicly stated he did not know whether to buy Facebook stock or not. He decided not to and missed a big gain. Think about this, a billionaire genius businessman who missed out and never bought the stock. How can this be? Likely reasons are due to fear of loss or inability to value the stock. Lets break that down and figure out what it means. Lets assume for the sake of this experiment that he was considering an investment of $1 million worth of FB stock, and there lies the problem. The solution to remove fear is simply to reduce risk by splitting a trade or investment up into smaller tranches. Lets split a million into six equal bits, and lets not add a second trade unless that first trade shows a bit of promise by going up. The first trade size would be $166,666 and if a generous 20% stop is used this cuts risk to a $33,333 which is much less than the $1 million. The same logic can be used when trading futures and stocks in any time frame and with any type of frequency. If the initial trade is going well, then it can be added to in any size that is used and if it is going wrong it can be reduced in size, the same applies to short selling, if they are collapsing nicely you can add to them. During rallies you can reduce the size automatically. Important concept to get across The maximum long position will be your entered values for long size x the number of long tranches. This needs to be equal or less than you normal and correct risk percent of capital. Generally most pro traders risk around 0.25% to 1.5% of capital per trade, with a majority risking 0.5% to 1% per position. So the mode of operation is to pyramid UP TO your correct size and NOT to pyramid over that size. Please understand this point. Example operation No.1 If a trader usually deals in 10 contracts of MNQ Micro Nasdaq futures then the settings can be as follows Long Size =2 and LongTranches = 5. So the maximum long size will end up as 10 contracts. Or another method would be Long Size =5 and LongTranches = 2. So the maximum long size will end up as 10 contracts. If the same trader likes to enter short trades but in the smaller size of 3 contracts then the settings would be ShortSize =1 and ShortTranches =3. So the maximum short size will end up as 3 contracts. Example operation No.2 Long only trades If a trader usually deals in 1000 shares and does long only trading the settings can be as follows. Long Size =200 and LongTranches = 5. So the maximum long size will end up as 1000 shares. To ensure no short trades are placed then the settings would be as follows ShortSize =0 and ShortTranches =0. No short trades. Example operation No.3 The slightly bearish trader If a trader is bearish and wants to deal short in 60 contracts and enter long trades in 30 contracts the settings can be as follows. ShortSize =20 and ShortTranches = 3 making 60 total.....or ShortSize = 10 and ShortTranches = 6 making 60 total....or ShortSize = 12 and ShortTranches = 5 making 60 total. Long Size =10 and LongTranches = 3. So the maximum long size will end up as 30 contracts or shares...or Long Size =5 and LongTranches = 6. So the maximum long size will end up as 30 contracts or shares....or Long Size =7 and LongTranches = 4. So the maximum long size will end up as 28 contracts or shares. This method puts you in total control of your trading size and can be operated manually or with auto-trading. Example operation No.4 The long term slow trader / investor Going back in time to Microsoft stock from 1995 to present day and doing just 39 trades while acheiving a risk - reward ratio of 9.7 without any optimizations with a win % of 52. Most of the big moves were nicely caught using Sensitivity settings of 120 and LowStopBars of 180 and HighStopBars of 100 ( Any similar approximate values would have been effective on MSFT over that period ) LongTranches was set at 6 and ShortTranches was set at 3 Ideal method for the long term trader and the medium term trader. There were some drawdowns during large fluctuations which got washed away when the big up trends arrived. The investor logic is simple If a market is going to grow by 5 or 10 or 20 times then first it has to go up by 50% and double or treble, you can catch it with HATS 6 on the first instance of a new all time high and let it leg gradually into a position. The time of writing December 2023 there are several well known stocks hitting new highs so there will be some other less well known stocks doing this. Maybe it is time to Go daddy go :) How to set up HATS 6 General eyeballing is the best place to start. Plot your usual time preferred frame and add the strategy, click on ShowPlots. HATS is a FRACTAL strategy so it is able to fit any time frame. Try it on 100 tick or a 10 seconds chart to a 2 minute chart to and hourly chart up to daily and weekly charts. Scroll though where the entries and exits are and look for moments that do not fit your own style. Adjust the sensitivity settings up or down a few points and look again. Sensitivity does not have a default value even though a value of 52.3 shows up so you are advised to experient with a narrow range between 40-60 and understand how it works. Once you get the idea you can try large and smaller ranges until you find your preference. Some traders may want to use values greater than 100 for slower trading. Faster traders who like to use or tick or second bars may prefer 20-40 values. When the upper plot called Next Long Entry is greater than on the previous bar a buy order is triggered ( or a partial short exit ) The reverse is true for the lower plot called Next Short Entry which has to be falling for a short entry or a long reduction trade to be activated. You will see the two grey plots which are called HighStop which is the highest close over the N bars specified and the LowStop which is the lowest close over the N bars you choose. When the price hits these lines it will trigger the entire exit of the longs or short positions. These are added as a safe guard if trader want to tighten up the product so prevent gradual legging out of trades in the step by step manner. If you like to use this tool for Day trading then simply check the box Exit on session close and follow the same set up procedures as above. Troubleshooting / FAQ No plots are visible = tick show plots Some plots are visible and others are not = check chart background colour is not the same as indicator colours. The lines are too close together and are both far away from the market prices = Increase Sensitivity setting ( Bigger = less trade frequency ) The grey lines are closer than the NextLongEntry lines = Increase value of LowStopBars to avoid entire trade exits too early. Too many trades = Increase Sensitivity setting ( Bigger = wider ) and increase LowStopBars and HighStopBars Not enough trades = Reduce the Sensitivity setting and / or reduce LowStopBars and HighStopBars values. If you want to use indicator only, then add the strategy to the chart click on ShowPlots then set Long Size and Short Size to 0 and it will not trade. No trades happening = load more bars in your chart as it needs 120 bars to start working also check the sensitivity value is not too big. To those who like the fancy charts type with fancy names, there is no advantage to using them as no chart can change the price of the market. Buy at market orders will be filled at the price on the exchange and not at the price on the pretty coloured chart you may be using. It is advisable to stick to bar charts or candle charts or line charts for simple operation and clear indications. Too many entries per direction? - Reduce LongTranches value to what you need ( same for ShortTranches ) Too much time passing before getting 6 longs executed = Reduce sensitivity setting or reduce time frame. Vice versa if too fast. Remember HATS 6 is fractal, once you find settings that suit your style, you can adjust the chart time frames until you find the best results. |

-

Graphic tutorial HATS 6 The

set up

The INCORRECTLY set up example below

shows sensitivity is

too tight. (Large numbers make it wider, small numbers

make it tighter)

This is clearly obvious because both

coloured plots are way below the price action.

Also the

HighStop and LowStop lines are

too tight causing an early total exit from all six long trades

at 906 am

The design is supposed to be entering new

trades when the price breaks up or down to a new level, it is

not intended to trigger a trade on every bar.

The

strategy will still function if set up incorrectly but will

generate too many trades and likely result in a losing strategy.

Notice it trades on almost every bar it can find until full

trade size is reached showing it is not set up correctly.

Below on the same data range

zoomed out a bit you

can see buy signals are generated when the blue line has risen

and the grey exit line is a more sensible distance.

For

my preferences these

settings are still too tight as in too close to the prices, but this product is

designed to cater for all the tastes of traders.

It

caters for extremely high speed trading right across the

spectrum to suit extremely slow

frequency trading and investing.

The

upper grey line is following the highest close (which is going

up) so its naturally tight and will appear much wider in a down

trend.

The Settings of this product are

somewhat inter-connected so it is possible to set it up in ways

that are not ideal.

To give maximum control and

flexibility to the user it has been given a wide range of

settings ranging from way too fast to way too slow.

This

is done to give the experiementers full scope to test all manner

of ideas. Some of these may lead to good

results and uses in a manner

that was not intended by me

as the

designer, that is part of the journey of discovery that traders

enjoy sharing.

Often my customers come up with ideas and uses

which I did not consider, so go ahead and run your tests and

please let

me know what you discover.

My intention is to help you leg

into full size trades in small steps thus reducing your initial

risk and reduce trepidation, scared money syndrome and removing

FOMO.

Enjoy the journey!

HATS 6 for NinjaTrader 8

licenses

HATS Unlimted for MultiCharts licenses

HATS Unlimted for

Tradestation licenses (ready now)

2 month trial $69

1 year license $135

5 year license $285

10 year

license $385

To get a 5% Discount

you can pay in CHF or if you want a

10% discount you can pay in BTC

Short trades and longs - Fear of big losses is removed just like the lyrics state, I aint afraid no more... |

-

The below is set to enter in 8 long tranches- shown in the MultiCharts version...do you get the idea? |

-

Just reminding you that the MT4 and MT5 indicators are only priced low for the few days. So no time to waste, check out the MT4 and MT5 tools page.

|

|

|

| Admin notes |

| Page created on December 10th 2023 - New responsive page GA4 added canonical this. 5/5 html sm links added - responsive- HATS V1 releasing today |