Many people have wiped out their trading account due to naivety about

this exact point.

You might be a little angry at spending 20 seconds typing in the numbers

but it is cheaper than losing all your money.

Example No1 The Enron scandal

and collapse

|

| |

| |

|

Enron plc

Showing a

minimum price of zero, was once a hugely popular investment

entity with the public and institutions alike.

False accounting

was going on behind the scenes and the company collapsed in 2001

Those in charge were running a systematic, creatively

planned accountancy fraud, which later became know as the "Enron

scandal"

Minimum price = zero

|

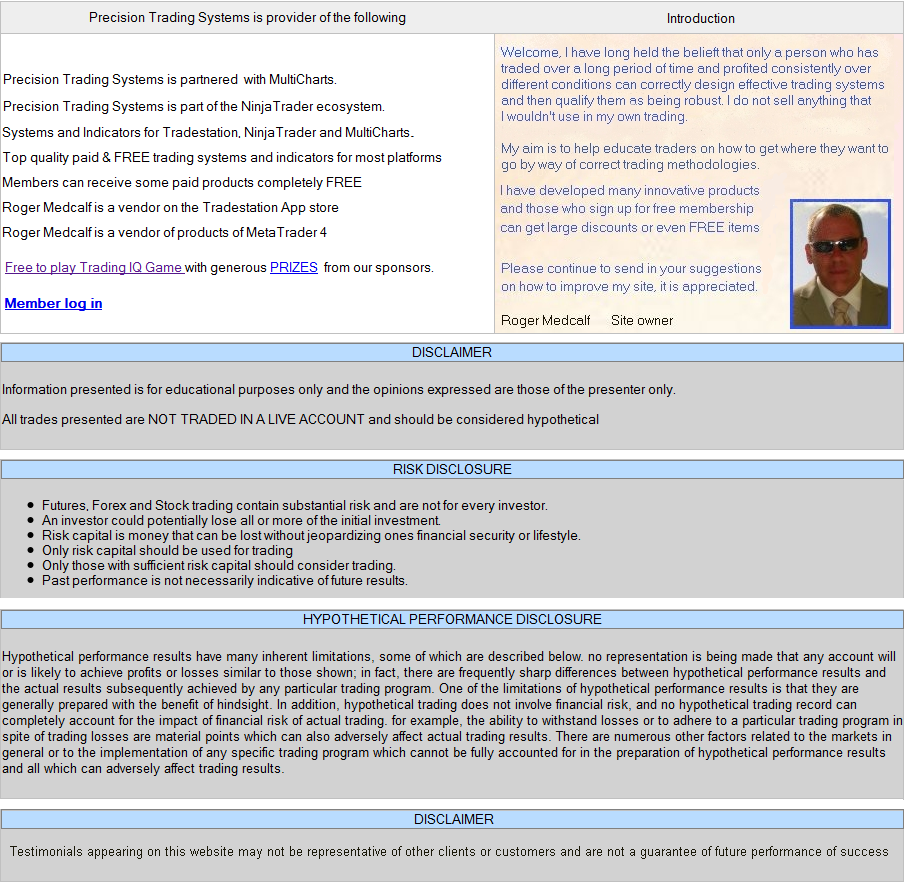

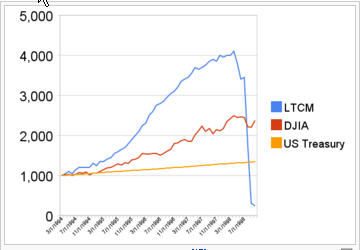

Example No2 The Zimbabwe stock

index ZSE

|

| |

| |

|

The (ZSE)

Zimbabwe stock index

Maximum price = 4,000,000 an

approximate 40,000 fold increase.

This is not infinite,

but it sure is a drastic increase from 1102 in 2006.

The

money printing of financial genius (sarcasm) Robert Mgabe lead

to hyper-inflation in Zimbabwe which in turn caused rocketing

stock prices.

Investors in stocks apparently faired

somewhat better than those who held cash. For the general

public, the outcome was not very good, as the price of

three

eggs reached 100 billion Zimbabwe dollars in 2007

See

videos of hyperinflation

Maximum price = 4,000,000 (not

infinity but very high)

|

| Example No3 Polly Peck

collapse |

| |

| |

|

Polly peck started off as a small

textile company, which under the leadership of Asil Nadir made

it all the way into the FTSE 100 index in the eighties.

The company went bust in 1990 having unfunded debts of £1.3 billion.

The Polly Peck scandal as it came to be known led to so

law changes in the UK to prevent such fraudulent companies from

operating again.

Many expert analysts were fooled by Mr Nadir

who impressed everyone with his "successful image" all the time

the reality was very different.

Michael Walters who wrote for

the Daily mail, was amongst those taken in by his silver tongued

approach.

Minimum price = zero

TThanks to

Peter for providing this chart

|

| Example No4 Bernie Madoff and

infamous ponzi scheme |

| |

| |

|

The smile would fool many people,

he looks like a nice man.

What happened to all the money?

Madoff ran a "ponzi-scheme" which is a fraudulent

operation so designed to create the illusion of wealth and

prosperity but in reality is nothing more

than using new

investments to pay off those who wish to make withdrawals.

Investors were attracted to his 12% annual returns and he played

hard to

get when taking on clients, making them believe he only

wanted money from a few select people. As a result they were

falling over themselves to invest.

When the stockmarket

became weak in 2008 Madoffs investors became jumpy and many

wanted to withdraw funds, Madoff had already spent most of

the

money and decided to confess to the authorities.

The SEC

were warned many times that his 12% interest growth was

physically impossible, but they failed to investigate the alarm

bells raised years earlier.

He is currently serving a 150

year prison sentence in USA.

What happened to all

the money?

Bernie Made-off with it |

| |

|

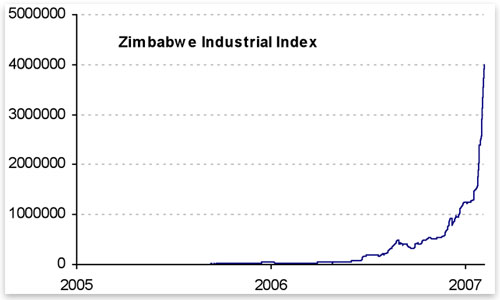

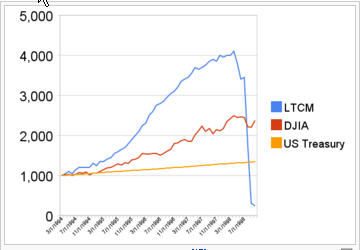

Example No5 The Long

term capital management collapse LTCM |

|

|

|

|

| |

|

LTCM Collapse LTCM (Long term

capital management)

The correct name would be long term

capital mis-management.

This company even won a nobel

prize for its expertise! LTCM had calculated maximum levels for

option volatility based on a comprehensive study of

historical

data.

Their model assumed that prices had upper

boundaries and should be short sold when at the upper boundary.

Their model also made a the fatal misjudgement to assume

that prices would move in orderly 0.25 increments with good

liquidity at each level.

They did not factor that

markets can gap in large amounts.

LTCM returned around

20% a year to clients until the Russian debt default of 1998

sent option prices soaring to previously un-seen levels.

As they were "short of volatility" their losses were

catastrophic.

Maximum price of option volatility

= infinity Therefore...

Minimum price of LTCM fund = zero

The moral of the story has to be this.

Just because its

never happened before, it doesn't mean it wont ever happen.

Many of the top cyrpto currency traders of the day are

stating the they are deeply involved in ponzi scams. Pump and

dump.

There is not a lot of substance to any of them in

the long term although there are many great trading

opportunities to be had.

Bitcoin BTC is generally

considered to be going to a million or to zero. Just as in the

example above. Interesting to bear that in mind.

|