| Tradestation Products | MultiCharts Products | TradingView products | NinjaTrader Products | MT4 and MT5 Products |

|---|

Precision Stop Setup and instructions for Tradestation & MultiCharts.

How to set up Precision Stop for Tradestation

|

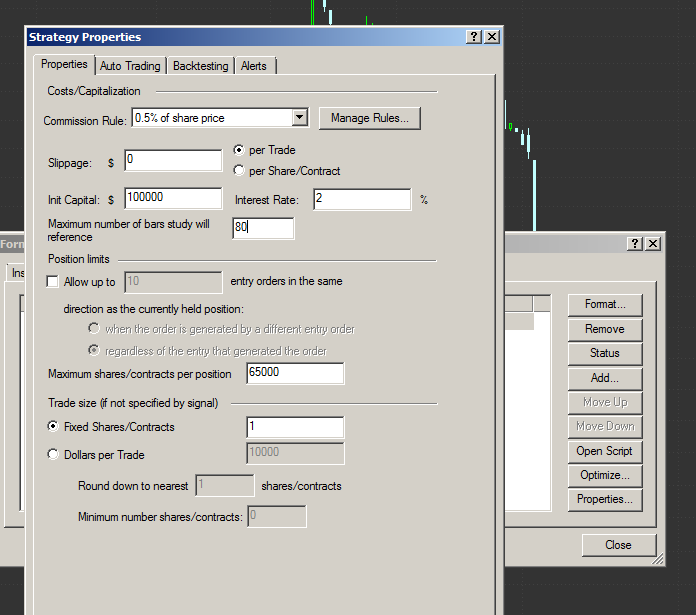

Instructions for the Precision stop for Tradestation Precision Stop for Tradestation and Multicharts instructions for use. Importing into Tradestation In Tradestation, open power editor and import the Precision stop indicator and the Precision stop signal for Tradestation. (There are two extra functions required, called PrecisionNOISE and PrecisionVOLA which should verify automatically) Tradestation set up and instructions Create a chart window with the symbol of your choice Plot the Precision Stop indicator You will need to set max number of bars the study will reference to user specified 90  Subchart 1 Scaling Same as symbol update every tick Error message if ignoring the advice..  Make a visual observation of the points where Precision Stop changes from long to short, and then adjustments can be made as follows Right click on PS and select format precision stop If PS appears to close to the price action, then increase the MULTIPLE setting if PS appears to far away from the price action, then reduce the MULTIPLE setting Suggested MULTIPLE values for differing time frames Weekly and Monthly charts 3 to 10 Daily charts 1 to 6 Hourly charts 0.25 to 3 Minute charts 0.01 to 0.7 Second charts 0.001 to 0.2 Tick- Change 0.001 to 10 You will also see the features MAXPERCENT and MINPERCENT These are to prevent PS from going too tight to the price, or too far away from the price, and if you notice the stop is not getting tighter when reducing MULTIPLE values, you may like to try reducing MINPERCENT. Once you have established settings that look approximately correct to suit your trading style, then you can add the Precision Stop SIGNAL. Making sure you repeat the above procedures to set max number of bars the study will reference to user specified 90 and all the relevant MULTIPLE, MAXPERCENT and MINPERCENT. At this point you can choose POSITION to be true or false POSITION TRUE will let the PS continue naturally always in the market long or short and it will never flatten positions. POSITION FALSE (day trading mode enabled ) This mode enables the user to configure at which time the system will exit all trades which is ENDTIME. (set to 2 or 3 minutes before the close time) LASTTRADETIME is the latest time that the system is allowed to enter a short or long trade and is designed to prevent trades being placed just a few minutes before the ENDTIME you specify. Once you have decided on your time frames and parameters, you can then add commissions and slippage to the properties and begin optimizing to test the best parameters. Note: The MULTIPLE setting is most sensitive to small changes, and huge differences to performance can be observed from small changes in this setting. Generally to get maximum efficiency it is best to first optimize a broad range of MULTIPLE values and then plot the results to see if you have a BELLCURVE shaped distribution of readings. If you achieve this, then there is a good chance that the PS will work very well in the mid point of the BELLCURVE. If you do not see a bell curve distribution then experiment with different time frames of the market and different MULTIPLE settings. The final system you select to use should produce a nice smooth rising equity curve chart with low draw downs which are low relative to the profit achieved. If you have not produced a smooth rising equity curve, then you will likely not have the best results from PS in the modes selected. See the simulation video on this link Precision-Stop-Tradestation It is not always possible to achieve a suitable performance report when testing PS, and if you have the slightest doubt that the PS is not robust in the chosen market and timeframe then it is often best to select another market and/ or timeframe to test. This is a trend following method, which will win handsomely in trending periods if set up correctly. Finally, if you experience any difficulties in your application of this product, please drop me an email to precisionts@gmail.com and will try to resolve your issue. I wish you the best of success with your trading! Precision trading systems Two exciting products. PLA Dynamical GOLD the worlds best moving average or your money back I wish you a found new confidence in noise elimination and speed changing technology. After months of hard work the 101 speed Moving Average that adjusts itself to fast and slow price action is ready for release. This product is the most advanced commercially available moving average today. Comes in 3 versions from beginner to expert. Mach-Trend Platinum Pro the low frequency trend following model The strategy your broker will hate. It does very few trades and still locks onto all the major trends. Eliminating a huge of amount of whipsaw trades, it contains advanced settings to suit all levels of user. Can be made slower and faster with skew and delay functions as well as the usual length adjustments. |

|

|

|

More simple to understand examples of using easy language code on this page Suitable for beginners and experts as the code is unusual and innovative. |

-

|

Some amazing trading stories can be found here. Some interesting philosophical quotes can be found here. Trading IQ Game with PTS products as prizes Risk management in the sense of protection from market crashes with guidelines on stops to enter shorts. Optimal trade size for maximum gains Beginners and intermediate traders guide tutorial in six parts with examples and diagrams |

-

|