Precision Stop Indicator and Strategy for MultiCharts

If you require this item for a different platform please visit the product guide

It can also be used as indicator only in MultiCharts when used for manual trading

and be set up for day trading or position trading

The Precision Stop Trading system and indicator can be fully automated or used manually in MultiCharts and operates as a SAR type ( Stop and reverse )

System introduction

The Precision Stop indicator and

strategy has been tested extensively and proved itself to be ultra reliable

and robust ( The video below shows this testing )

Precision Stop

trading system follows the rules of trend following with losing

trades cut quickly and winners left to run to ensure good MAR and

lake ratios.

Precision Stop can achieve good risk v reward ratios and low draw downs

when applied to suitable markets with trending attributes- Low

periods of underwater.

Advanced features

Precision Stop has advanced volatility detection with three different time frames of "memory look back" to take the guess work out of trading.

Precision Stop can

be set up correctly set up by a beginner or intermediate or expert

trader using the simple user guide. The complex algorithm does all

the hard work for you.

Precision Stop has a huge range of multiple settings for microscopic adjustment to fit different market data behaviour.

Precision Stop can be used as a fixed symmetrical percentage model if required,

for example if the price moves 2% up from the low it will buy and 2%

down from the high it will go short.

Under normal use the maximum and minimum percentage setting which can

be used to restrict the algorithm from being too tight or too wide

to suit user preferences.

Non-fractal in behavior. This is

due to the large array of periods used in the volatility equation.

It does not behave in the same was as a moving average when time

frame is changed.

Standard features

Precision Stop has an accurate colour changing plot that provides at a glance position detection depending on colour

Precision Stop default use is as a stop and reverse model

but can also for part of a team when used in combination,

see the Precision Stop with Pi-Osc combo model

here

Precision Stop can be used for position trading ( holding overnight ) or set to close trades at any time you specify if

you are intra day trading

Precision Stop is fully optimizable so you can rigorously test all the settings for best performance.

Precision Stop works on any type of chart in the MultiCharts platform.

Technological advancements

Precision Stop has been completely re-programmed in efficient fast code to handle the high speed data of modern markets.

Precision Stop was converted to VB.Net for the purpose of creating an independent simulation unit for testing which is shown in the video below.

View

license prices for Precision Stop for MultiCharts

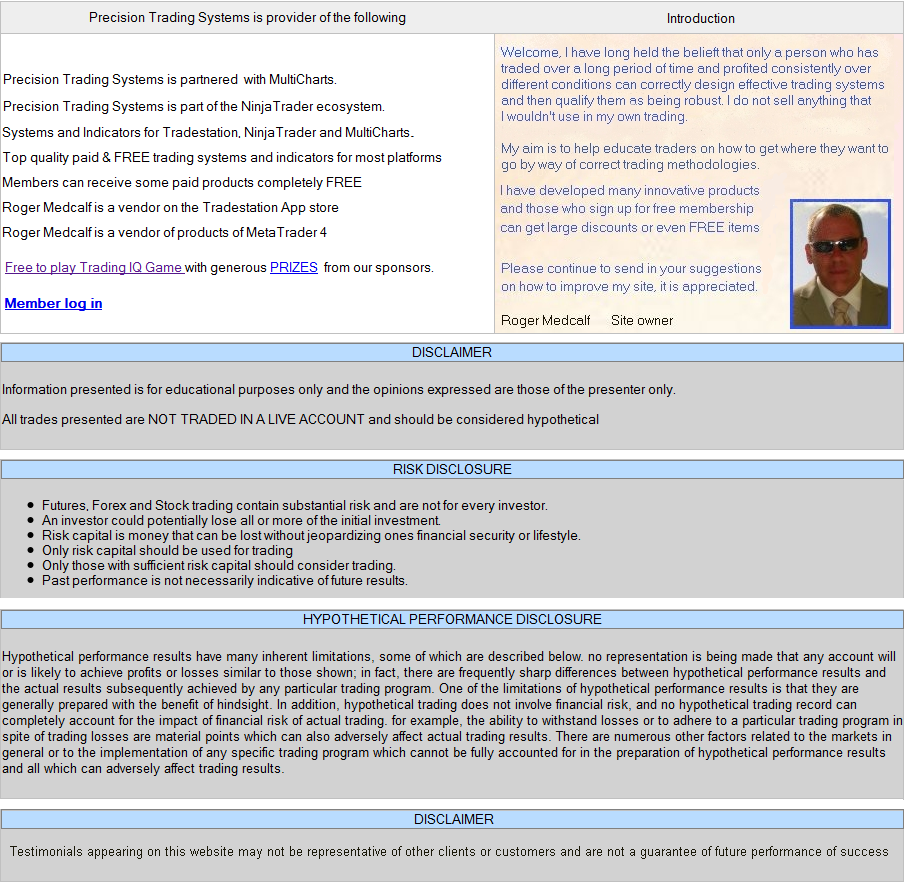

The Precision Stop strategy shown below with

a Multiple setting of 2 can catch some huge moves due to widening in high

volatility

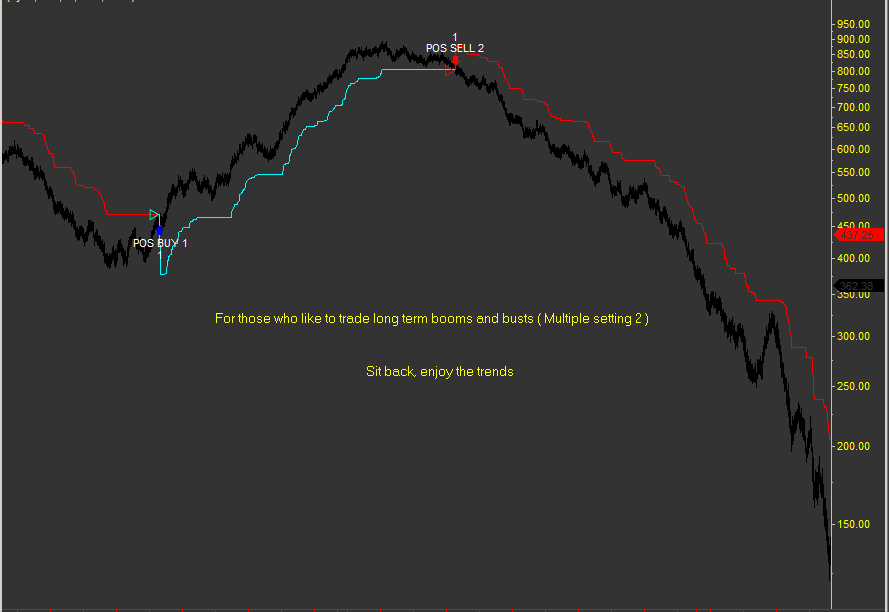

Precision Stop has a complex volatility algoritm which is adaptive

to local market conditions:

The shot

below shows it does not tighten distance if volatility stays high, this

helps it to learn how to

reduce the chances of whipsaw trades.

Whipsaw reduction is a

key element of this trading strategy.

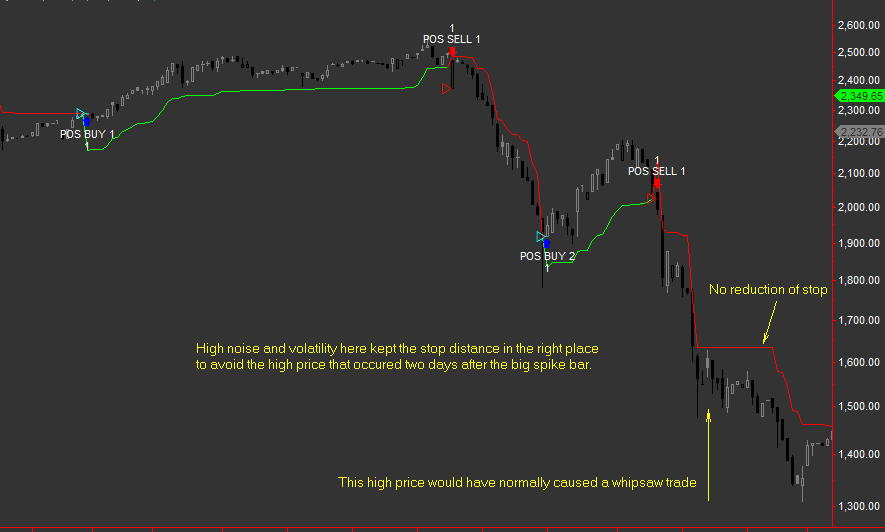

The Precision Stop strategy can be used for intra-day

trading and set to prevent opening a new trade after the time specified by the user.

The

default setting is POSITION = TRUE. Which means it will hold trades overnight.

If you set POSITION = FALSE it will close out the trades after the

time you specify.

Precision Stop Indicator and strategy in POSITION = TRUE mode runs

naturally until the trend changes direction, then it reverses ( SAR mode)

Precision Stop below is set to a specified ENDTIME exit, so you

can go about your business and know it will exit the trade when you

told it to

Precision Stop Strategy was used in the video simulation below over a

10 year period on 70 stocks at once.

The results speak for

themselves.

Watch the cell marked as "W-Equity" where my

mouse pointer starts. This is the equity of the model over the duration

of the simulation.

Read the full article on how to test a trading strategy which shows

the full glossary of trading terms used in backtesting a strategy

correctly.

PRECISION STOP FOR MULTICHARTS FULL

INSTRUCTIONS FOR OPERATION.

Precision Stop User guide is on this page which covers what all the

setting are used for

View

license prices for Precision Stop for MultiCharts

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 5 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and

MultiCharts.

Page Created July 4th 2023 to

replace old page - New responsive page GA4 added canonical this. 5/5 html baloon

cookie notice added

About